JAMES HARDIE INDUSTRIES PLC : JHX Stock Price AU000000JHX1

19 10 月, 2021 9:14 下午 Leave your thoughtsContents:

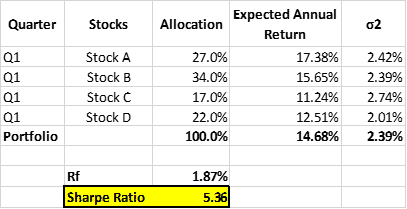

James Hardie Industries has a dividend yield of 1.00%, which is in the bottom 25% of all stocks that pay dividends. James Hardie Industries has a short interest ratio (“days to cover”) of 0.6, which is generally considered an acceptable ratio of short interest to trading volume. CANBERRA — Building products maker James Hardie Industries SE (JHX.AU) Tuesday reported a narrower third-quarter net loss of US$4.8 million, compared with US$26.4 million a year earlier. SYDNEY–James Hardie Industries PLC (JHX.AU), one of the biggest makers of cladding for U.S. homes, said Monday it more than doubled first-quarter earnings and may continue to pay out larger-than-usual dividends. As the year 2021 is close to wrapping up, the construction sector looks fairly strong, buoyed by solid housing market and infrastructural activities despite coronavirus-related…

Why is the James Hardie share price crashing 11% today? – The Motley Fool Australia

Why is the James Hardie share price crashing 11% today?.

Posted: Tue, 08 Nov 2022 08:00:00 GMT [source]

Mr Erter is an experienced executive, with experience in leading large enterprises in the consumer and industrial sectors. Mr Erter most recently served as Chief Executive Officer of PLZ Corp, a leader of specialty liquid and aerosol manufacturing. Headquartered outside of Chicago, Illinois, USA. Mr Erter was CEO from November 2020 to August 2022. From 2017 to 2020, Mr Erter held multiple executive leadership roles at Sherwin Williams, the world leader in paints and coatings. While at Sherwin Williams, Mr Erter was Global President of the Consumer Brands Group and Global President of the Performance Coatings Group.

How has JHX performed historically compared to the market?

Brokerage services for US-listed, registered securities are offered to self-directed customers by Open to the Public Investing, Inc. (“Open to the Public Investing”), a registered broker-dealer and member of FINRA & SIPC. Additional information about your broker can be found by clicking here. Open to Public Investing is a wholly-owned subsidiary of Public Holdings, Inc. (“Public Holdings”).

And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. CompareJHX’s historical performanceagainst its industry peers and the overall market. Price/sales represents the amount an investor is willing to pay for a dollar generated from a particular company’s sales or revenues. Style is an investment factor that has a meaningful impact on investment risk and returns.

using the price-to-earnings ratio and peg to assess a stock yield allows investors, particularly those interested in dividend-paying stocks, to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price. James Hardie Industries saw a decrease in short interest during the month of March. As of March 15th, there was short interest totaling 59,100 shares, a decrease of 12.7% from the February 28th total of 67,700 shares. Based on an average daily trading volume, of 98,600 shares, the short-interest ratio is currently 0.6 days. She previously served as Eaton Corporations Vice President of Finance and Planning for the companys truck and automotive segments.

0.01% of the outstanding shares of James Hardie Industries have been sold short. According to analysts’ consensus price target of $29.80, James Hardie Industries has a forecasted upside of 39.1% from its current price of $21.42. James Hardie Industries has received a consensus rating of Hold. The company’s average rating score is 2.17, and is based on 3 buy ratings, 1 hold rating, and 2 sell ratings. James Hardie Industries SE JHX.AU said Tuesday the head of its U.S. business, Nigel Rigby, is leaving the building-materials company effective June 30.

These investments are speculative, involve substantial risks , and are not FDIC or SIPC insured. Alternative Assets purchased on the Public platform are not held in an Open to the Public Investing brokerage account and are self-custodied by the purchaser. The issuers of these securities may be an affiliate of Public, and Public may earn fees when you purchase or sell Alternative Assets. For more information on risks and conflicts of interest, see these disclosures. Discuss news and analysts’ price predictions with the investor community. Real-time analyst ratings, insider transactions, earnings data, and more.

ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities. Biden’s disturbing new government program may be worse than Obama’s. A former bank regulator is blowing the whistle on Biden’s frightening plan to take over your money.

Over the past 37 months, JHX’s revenue has gone up $1,269,100,000.The table below shows JHX’s growth in key financial areas . Stocks with similar financial metrics, market capitalization, and price volatility to JAMES HARDIE INDUSTRIES PLC are AXTA, HAYW, EPC, CCF, and NXTP. With a market capitalization of $9,542,412,715, JAMES HARDIE INDUSTRIES PLC has a greater market value than 83.46% of US stocks. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. All investments involve the risk of loss and the past performance of a security or a financial product does not guarantee future results or returns.

James Hardie Industries Stock Chart and Share Price Forecast,

T-bills are subject to price change and availability – yield is subject to change. Investments in T-bills involve a variety of risks, including credit risk, interest rate risk, and liquidity risk. As a general rule, the price of a T-bills moves inversely to changes in interest rates. See Jiko U.S. Treasuries Risk Disclosures for further details. Brokerage services for alternative assets available on Public are offered by Dalmore Group, LLC (“Dalmore”), member of FINRA & SIPC. “Alternative assets,” as the term is used at Public, are equity securities that have been issued pursuant to Regulation A of the Securities Act of (“Regulation A”).

Exchanges report short interest twice a month.Percent of FloatTotal short positions relative to the number of shares available to trade. There may be delays, omissions, or inaccuracies in the Information. The banking crisis has added to the mounting pessimism among shale producers about the direction of oil prices. After a stellar 2022 that saw record cash flow and healthy shareholder returns, industry fears of a recession are casting a pall over the shale patch. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions.

Independent Non-Executive Director Nigel Stein Just Bought A Handful Of Shares In James Hardie Industries plc (ASX:JHX)

JSI and Jiko Bank are not affiliated with Public Holdings, Inc. (“Public”) or any of its subsidiaries. None of these entities provide legal, tax, or accounting advice. You should consult your legal, tax, or financial advisors before making any financial decisions. This material is not intended as a recommendation, offer, or solicitation to purchase or sell securities, open a brokerage account, or engage in any investment strategy. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. The GARP strategy helps investors gain exposure to stocks that boast impressive prospects and are trading at a discount.

The group’s key geographic segment is North America, where it is the largest manufacturer of fibre cement producer and generates around 75% of its earnings. The remainder of earnings are derived from its Asia Pacific businesses in Australia, New Zealand, and the Philippines, as well as Europe. In 2021, the group acquired Fermacell, a fibre gypsum building products business headquartered in Germany with operations throughout Europe. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

https://1investing.in/ are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements. Money Flow Uptick/Downtick RatioMoney flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an “uptick” in price and the value of trades made on a “downtick” in price. The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades.

Other roles included heading Sumitomo 3M, the subsidiary of 3M, headquartered in Tokyo, Japan. Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world’s media organizations, industry events and directly to consumers.

Mr Wiens has senior executive experience in operating in international environments. Mr Wiens had a career across 38 years at 3M Company leading several of its business units, including the Industrial Business and Transportation Business from 1998 until his retirement from 3M in 2006. During this time, Mr Wiens restructured the business, managing a global implementation of Six Sigma that drove international growth.

11 Best Cement and Construction Materials Stocks To Buy Now – Yahoo Finance

11 Best Cement and Construction Materials Stocks To Buy Now.

Posted: Mon, 24 Oct 2022 07:00:00 GMT [source]

Price/book ratio can tell investors approximately how much they’re paying for a company’s assets, based on historical, rather than current, valuations. Historical valuations generally do not reflect a company’s current market value. Value investors frequently look for companies that have low price/book ratios. Consensus Price Target is the stock price analysts expect to see within a period of 0-18 months.

- These returns cover a period from January 1, 1988 through February 6, 2023.

- None of these entities provide legal, tax, or accounting advice.

- JHX has a forward dividend yield of 0.01%.SeeJHX’s full dividends and stock split historyon the Dividend tab.

- Please see Open to the Public Investing’s Fee Schedule to learn more.

- You can find more details by visiting the additional pages to view historical data, charts, latest news, analysis or visit the forum to view opinions on the JHX quote.

She most recently served as Group Vice President of the Industrial Specialties business at Ashland Global Holdings Inc. from 2016 to 2019 where she aligned commercial and asset strategies driving focused profitable growth. Before joining Tyco, Ms Rowland worked for Rohm and Haas Company for over twenty years, where she held multiple senior executive roles including leading the global Adhesives division and Procurement & Logistics for the company. Investing.com – James Hardie Industries ADR reported on Monday fourth quarter erl-29531||earnings that missed analysts’ forecasts and revenue that topped expectations. Investing.com – James Hardie Industries ADR reported on Monday first quarter erl-29531||earnings that beat analysts’ forecasts and revenue that topped expectations. The average analyst rating for JHX stock from 19 stock analysts is “Buy”.

Categorised in: Forex Trading

This post was written by pencil